The U.S. equity market is very expensive, according to most measures of stock market pricing.

According to James Montier of GMO, the U.S. market is “obscenely” overvalued.

Why are money managers still buying?

James Montier wrote a 7 page piece called “The Advent of a Cynical Bubble” on the valuation of the U.S. market. It can be accessed www.gmo.com, with a free registration.

Montier uses the Shiller P/E ratio, which shows a valuation of 32.80, the second highest valuation ever recorded, and only slightly lower than the peak in 2000 when it touched 44.

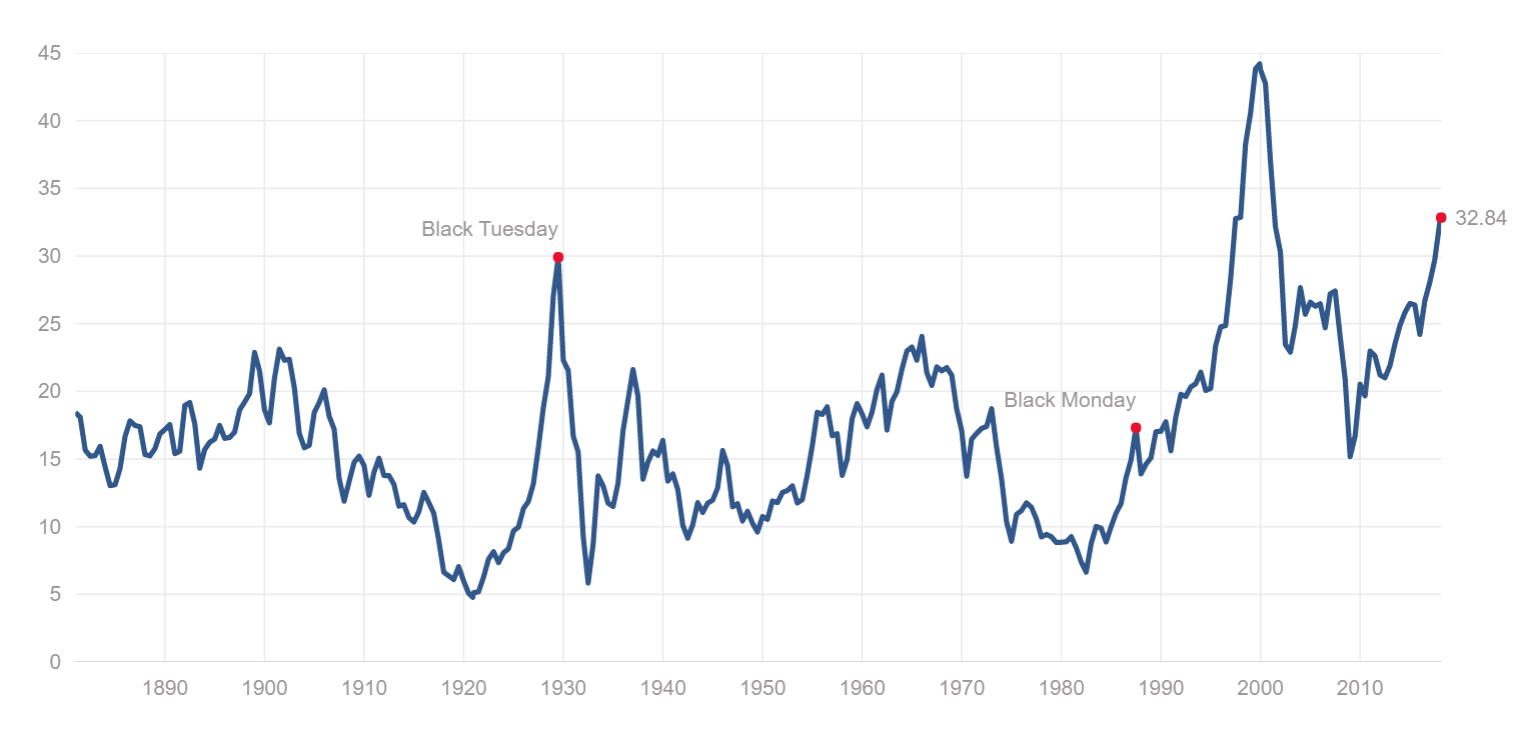

Shiller’s cyclically-adjusted price-to-earnings ratio for the S&P 500

Robert Shiller’s measure of the price-to-earnings ratio for the S&P 500 is cyclically adjusted using the 10-year average of as reported earnings. Earnings and prices are inflation adjusted. Source: R. Shiller

The peak was reached in December 1999 at 44 and the most recent bottom nine years ago was about 15. The long-term average is 16.83 and the lowest ever recorded value was 4.78. For several years, between 1974 and 1982, the Shiller PE ratio was below 10. Since the mid-1990s the ratio has been above average for the entire time, except for a few months in 2009.

In the 40 years since I started work as an investment advisor there have been market crashes about every five years. The most important events were:

- 1982 Recession and bear market (Shiller PE was below 10)

- 1987 Market crash (market dropped 20% in one day)

- 1989 Japan asset bubble peak

- 1990 U.S. bear market, dropped 18% in 3 months, Iraq invaded Kuwait

- 1997 Asian financial crisis

- 1998 Russia default; collapse of Long Term Capital Management

- 2000-02 Bursting of the dot-com bubble (also known as TMT or technology, media and telecom)

- 2006-09 U.S. housing and banking crisis, global financial crisis

At the time of each of these crises it seemed like a very big deal so many investors sold their stock positions out of fear, usually near the bottom. But in every case the stock market came back and hit new highs eventually.

The S&P 500 index that Shiller uses as proxy for the U.S. stock market has gone from approximately 100 in 1980 to today’s level of 2700. So, investors who stayed fully invested all that time should have no complaints.

According to Montier, the biggest problem professional investors face is career risk. They stay fully invested because they can be fired for getting out of a stock market that keeps rising, but they can’t be fired if the market crashes and they own stocks, because all other managers own stocks too. So they are what Montier calls “fully-invested bears”. They are cynical about the market because they know the market is expensive and a correction is inevitable, but they keep buying stocks anyway. This mentality is a big part of the reason that the market is so expensive now as the professionals control about 80% of the money in the stock market through mutual funds, pension plans and ETFs.

As I described in my 1999 book, Investment Traps and How to Avoid Them, the individual investor has a substantial advantage over these professionals. Unlike the professional, an individual investor can sell stocks and wait for better valuations without fear of getting fired. The biggest problem for the individual investor, if the market keeps rising, is resisting the very strong pressure of FOMO, or fear of missing out. And a lot of patience can be needed while waiting.

So, investors can choose. Either keep buying stocks like the professionals or do some selling to protect capital from a sell-off that will come, someday. It’s been nine years since the last bear market, so we are overdue.

Most investors would benefit by diversifying a portion of their risk assets to other markets and safer asset classes. This action will protect their capital from a catastrophic loss, and all they will need is enough patience to wait out this very expensive U.S. stock market.

Please contact Fraser Betkowski for more information on how to do this.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.